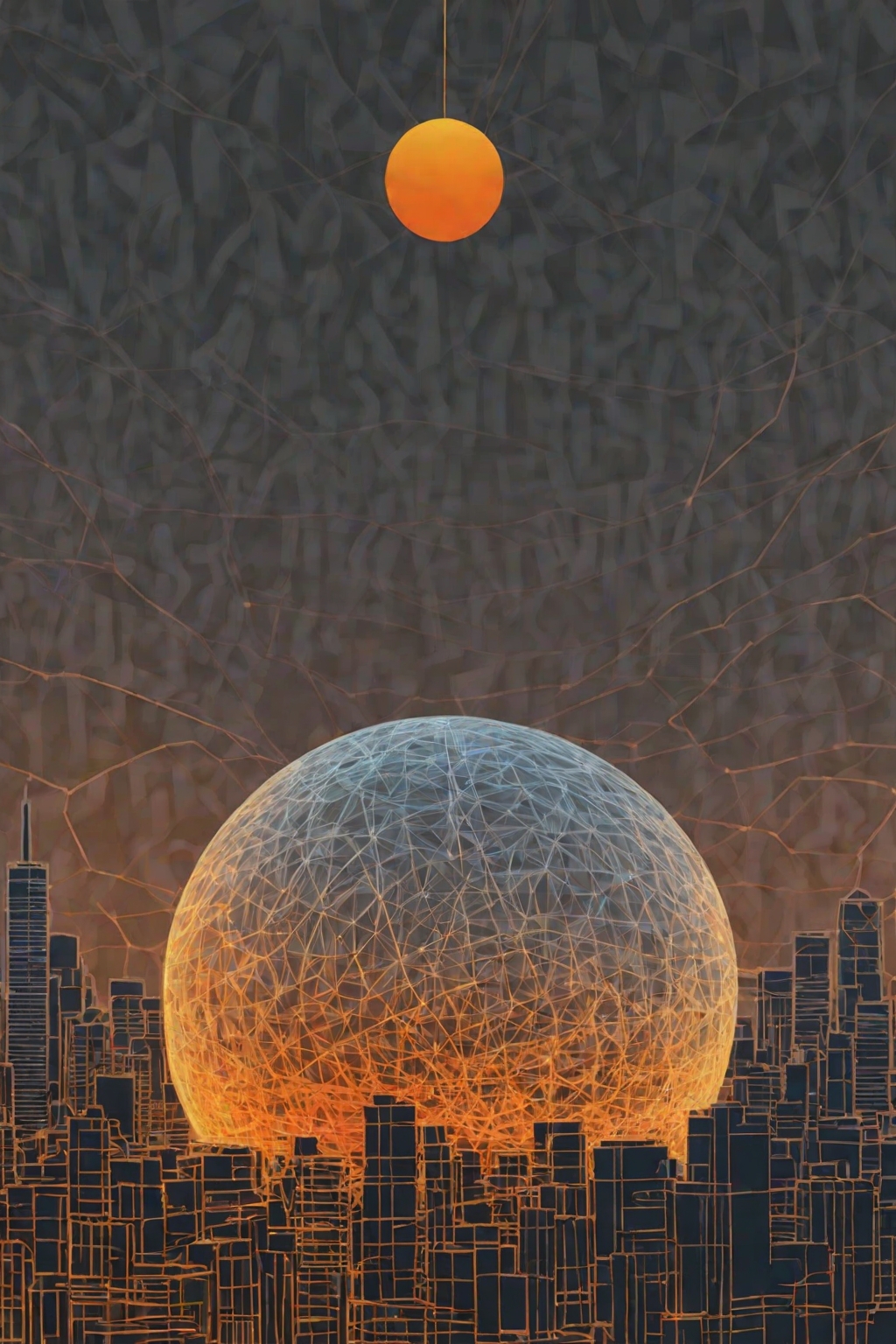

Bitcoin: Digital Gold in a Macro World

Think the BTC sell-off means Bitcoin is broken? It’s largely a macro story — rising real yields, tighter Fed expectations and risk-off flows drove the pullback, not a collapse of Bitcoin’s 21-million supply or its “digital gold” case. Institutional adoption and regulated products deepen demand (and correlations), so a small, tactical allocation with dollar-cost averaging and disciplined risk controls can turn this dip into a long-term buying opportunity — and alternative token designs like 4TEEN show how supply mechanics can actively shape market behavior.

Bitcoin’s recent pullback has been driven more by macro forces than changes to its core properties. That distinction matters because Bitcoin is still perceived by many investors as a scarce, non-sovereign digital asset — effectively “digital gold” — with structural supply mechanics that set it apart from fiat and most crypto projects.

Supply mechanics and scarcity

Bitcoin’s maximum supply is capped at 21 million coins; roughly 19.9 million have already been mined. That fixed supply schedule — baked into the protocol and decoupled from any central issuer — is a primary reason investors treat BTC differently from inflationary assets. Scarcity is a price-support narrative that gains traction when demand expectations or monetary alternatives change, but it does not immunize prices from liquidity shocks or macro-driven sell-offs.

Macro drivers that have pressured price

Recent declines in crypto markets have correlated with shifts in macro policy and risk sentiment. Elevated inflation readings, tightening expectations around Fed rate trajectories, and intermittent risk-off moves in equities and rates have reduced appetite for volatile, rate-sensitive assets. When real yields rise or risk premia expand, leveraged or discretionary buyers exit first — and that dynamic amplifies price moves in illiquid venues. Bitcoin’s sensitivity to broader market cycles has increased as institutional participation and cross-asset correlations have grown.

Institutional adoption and demand-side signals

Institutional flows, custody solutions, and regulated product launches have steadily expanded Bitcoin’s addressable investor base. That institutional tailwind supports the scarcity narrative by bringing larger, more stable pools of capital — though institutions also respond to macro and regulatory signals. The net effect is a market that may recover faster when those participants re-enter, but that’s conditional on risk-on conditions and balance-sheet considerations at the institutional level.

How to think about allocation and timing

For investors with diversified portfolios, a tactical, small allocation to Bitcoin can serve two purposes: diversification into a non-sovereign, hard-supply asset; and asymmetric upside if adoption continues. Because volatility remains high, sizing should reflect tolerance for drawdowns and liquidity needs. Dollar-cost averaging into a position during a drawdown reduces timing risk; treating any purchase as a long-term hold aligns with the structural scarcity thesis. At the same time, risk management (position caps, rebalancing rules, and stop-loss discipline at the portfolio level) remains essential.

Is the dip a buying opportunity?

The recent dip can present a buying window for investors who accept short-term volatility in exchange for long-term exposure to a scarce digital asset. That view presumes Bitcoin’s narrative as digital gold continues to attract capital and that macro conditions eventually normalize in a way that supports risk-assets. Investors should weigh time horizon, liquidity needs, and correlation to existing holdings before increasing exposure.

Tokenomics comparison: an example from alternative designs

Different crypto projects experiment with other supply and behavioral mechanics. For example, the 4TEEN token uses a fixed-price entry model and short, predefined holding cycles to limit immediate sell pressure and create predictable liquidity behavior, illustrating how token design can actively shape participant incentives without changing macro demand drivers.

Source reference: https://www.fool.com/investing/2025/12/12/what-is-the-best-cryptocurrency-to-buy-with-1000/

# Bitcoin, scarcity, digital gold, supply cap, institutional adoption

© 2025 4TEEN. All rights reserved.

Cryptocurrency investments involve risk.

Please do your own research.